Cutting-Edge financial Crime platform

Anti-Money Laundering

Address complex financial crimes with our end-to-end anti-money laundering (AML) compliance solution that monitors the entire customer life cycle

Key Features

Analyze

Fully end-to-end

Encompasses data integration, data quality, entity resolution, automated monitoring, AI/machine learning, investigation management and reporting – all on one unified platform to address your entire compliance life cycle needs.

Review

A modern, nimble platform

Accelerates the analytics life cycle via an innovative, cloud-native architecture that enables faster deployment cycles, access to the most advanced features and frictionless scalability.

Integrate

No-code/low-code interface

Offers a simple point-and-click visual interface for optimizing AML strategies and deploying machine learning capabilities.

Personalize

Transparency & explainability

Provides visibility into the decisions made by AI/ML models so AML teams can understand why activities were flagged and explain those outcomes and decisions to auditors, model governance staff and regulatory examiners.

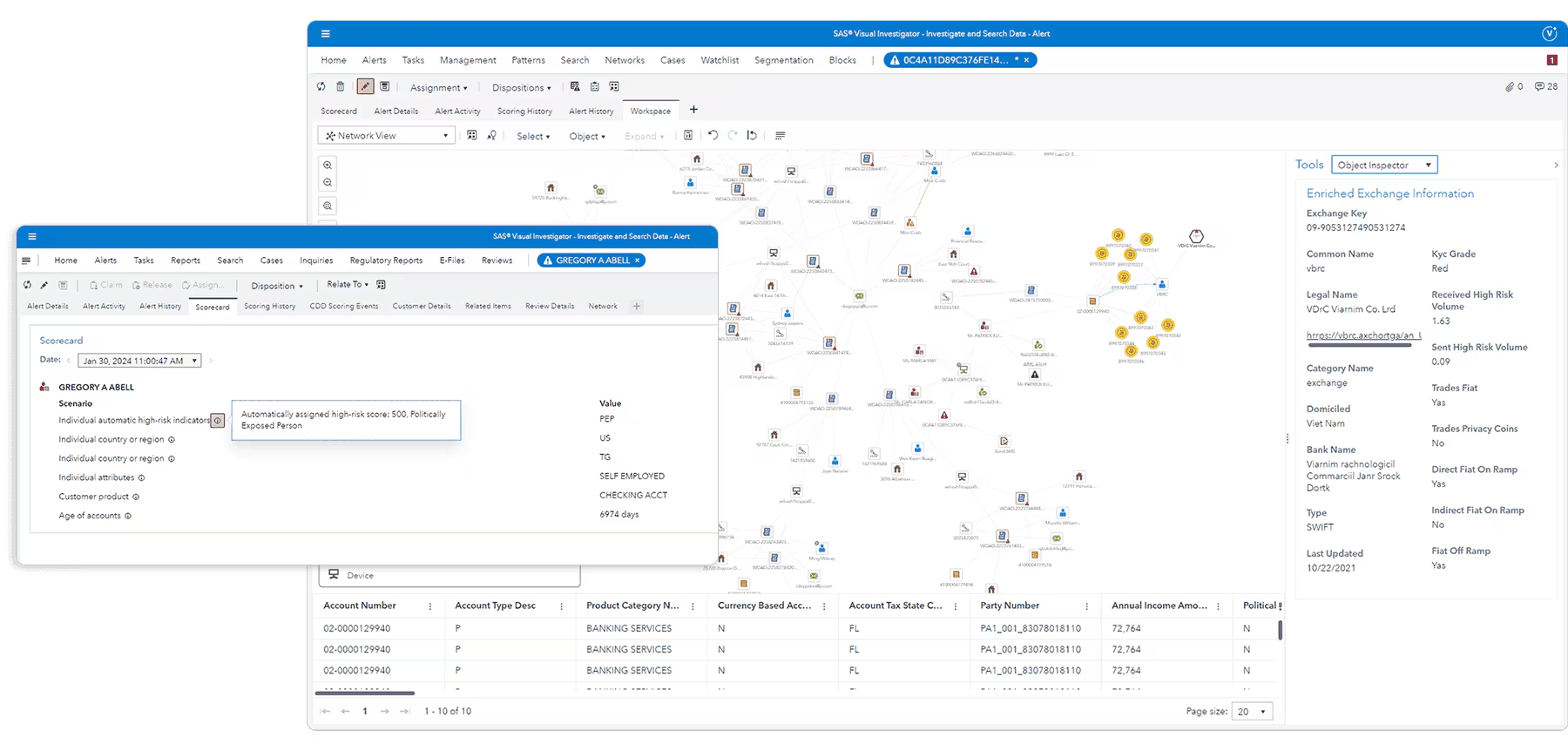

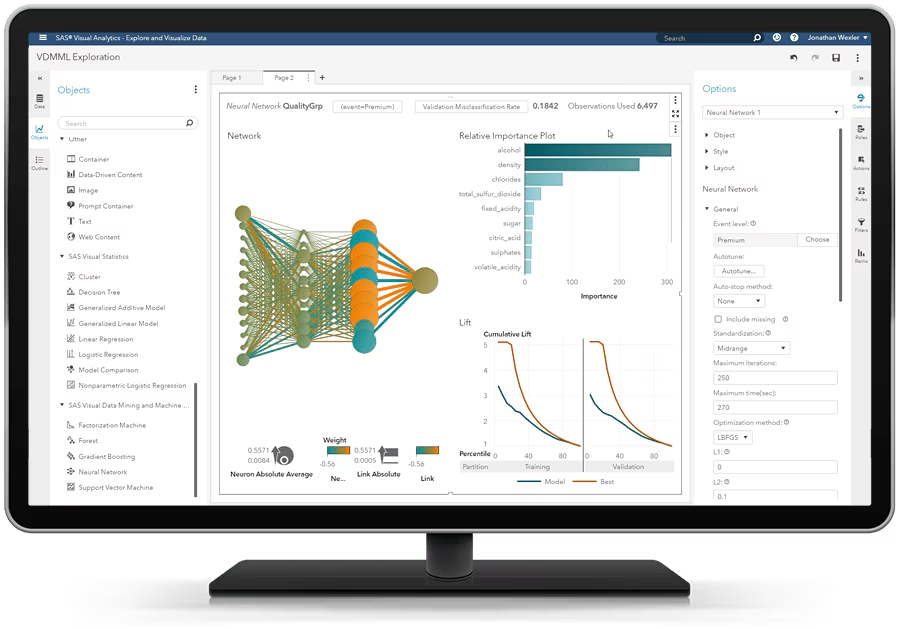

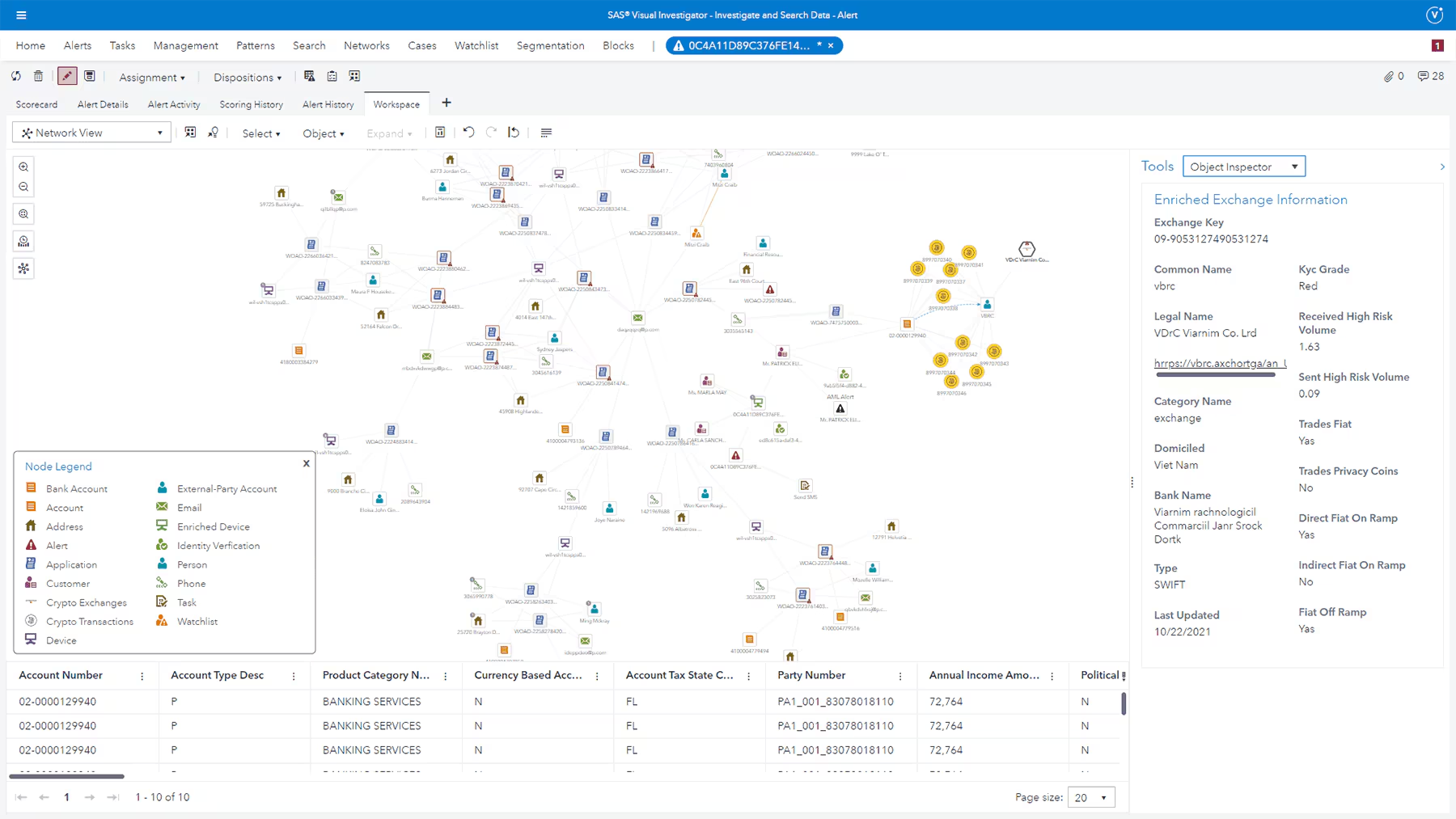

Detect complex threats with industry-leading AI and machine learning capabilities

Take a multidimensional approach to identifying complex threats, such as virtual currencies, human trafficking, trade-based money laundering and drug trafficking. Combine proven, out-of-the-box scenarios with industry data to identify unknown relationships through network analytics. Join our innovative clients who augment traditional approaches with award-winning AI and machine learning capabilities to identify complex anomalies.

Adopt perpetual know your customer (KYC) best practices

An integrated customer due diligence/enhanced due diligence (CDD/EDD) capability monitors changes in demographic characteristics that influence client risk ratings and behavior-based triggers from transaction monitoring processes to trigger enhanced due diligence reviews. The EDD workflow prompts analysts with dynamic checklists to ensure consistent capture of KYC information. Network analytics provides a visual metaphor of hidden relationships and notable risks for quickly identifying ultimate beneficial owners.

Meet your business needs with open administration

With low-code/no-code system administration, your institution can tailor the system to meet the needs of your business without requiring technical consultants. User-friendly, intuitive open administration capabilities offer a simple drag-and-drop visual interface for authoring surveillance scenarios, designing end-user screens, configuring dynamic workflows, and exploration and reporting.

Improve efficiency with enhanced entity resolution

The system summarizes potential suspicious activity from scenario-fired events at a customer or counterparty dimension, significantly enhancing efficiency compared with transaction-level reviews. Our real-time network and entity generation capabilities empower you to predict relationships, resolve entities by deduplicating entity records, plug intelligence gaps and uncover hidden relationships in real time based on the latest data without the need to execute long overnight batch jobs.

Fraud, AML & Security Intelligence

ANTI-MONEY LAUNDERING/CFT COMPLIANCE

Meet growing global compliance demands.

Comply with ever-changing regulations. Confidently and accurately monitor growing volumes of transactions. And take a risk-based approach to compliance that increases transparency and reduces your compliance risk.

Meet mandates for greater transparency

Adopt a complete solution that supports the entire regulatory compliance process, in less time and at less cost.

Visualize & simulate multiple scenarios

Detect suspicious activity faster than ever – in seconds, not hours. Simulate an array of models quickly, then test and tune before implementation so you can respond faster to emerging risk exposures

Focus more time on strategic goals

Apply powerful statistical optimization to models for more effective monitoring, accurate alerts and less false positives.

Strengthen your model governance processes

Simulate an array of models quickly, then test and tune before implementation so you can respond faster to evolving risks.

WHY AML/CFT Compliance?

Give due diligence to customers

Automatically integrate customers’ on-board risk scores with actual transactional behavior. Identify high- and medium-risk customers so you can monitor them more closely. And review a customer’s risk classification as needed.

Get greater transparency

Automated business process workflows ease your compliance burden by providing a detailed audit trail of system activities. All scenarios and risk factors are clearly documented, and contextual red flags indicate why one event is considered riskier than another.

Stay agile with fast implementation

Our financial services-specific data model is optimized for financial crimes analytics, and it incorporates data management best practices from more than a hundred successful implementations so you’re up and running quickly.

Expect trusted expertise you can count on

SAS has been the market leader in advanced and predictive analytics for more than 40 years. And we’re committed to continuous innovation to keep our customers at the forefront of security intelligence.

FRAUD & IMPROPER PAYMENTS

Anticipate, protect and prevent using modern analytics and embedded artificial intelligence (AI) techniques.

Safeguard your organization’s reputation and your bottom line. Stop improper payments associated with fraud, waste and abuse before they occur. Get early warning of emerging threats. And keep costs in check. SAS adds that essential layer of security intelligence protection.

Detect fraud, waste & abuse with precision

SAS takes a unique hybrid approach to surveillance, combining advanced analytics, AI and machine learning with traditional detection methods to uncover suspicious events. Our approach includes the latest advances in graph analytics, social network analysis, anomaly detection and text analytics.

Get a holistic view of your fraud risk

SAS gives you an integrated view across all channels and portfolios. Smart case management, entity link analysis, and AI and machine learning methods – such as outlier detection – reveal hidden relationships and suspicious associations among your customers, accounts and other entities across all lines of business.

Uncover new, complex fraud schemes

AI techniques, including adaptive machine learning methods and unsupervised intelligent agents, identify emerging threats and automatically suggest new rules and scenarios in real time, further reducing your risk from exposure to fraud, waste and abuse.

Why fraud and improper payments?

Data that’s consistent, accurate and timely

Take an enterprise approach to data management by bringing together cross-channel data – from all lines of business, organizational units and geographic regions – on a single platform.

Excellence in AI & predictive analytics

SAS is the leader in predictive analytics, with a market share twice that of our nearest competitor. We take an advanced approach to complex fraud challenges, delivering security intelligence solutions embedded with multiple AI technologies.

Better customer experience

With predictive alert analytics, you can automate decisions and prioritize investigative efforts. And our patented signature approach lets you simultaneously monitor multiple accounts belonging to the same customer for fewer false positives.

Flexible implementation

A common technology foundation and modular security intelligence solutions let you quickly deploy robust analytics for a quicker time to value. Multiple deployment options minimize your capital investment, simplify IT operations, and get you up and running fast.

IDENTITY & DIGITAL FRAUD ANALYTICS

Continuous protection across the customer journey – from application, to authentication, to account management.

Digital fraud is increasing, and the impact on your business can be tremendous. SAS empowers you to shield your customers and your organization from ever-changing threats. Get real-time results with our digital fraud analytics, AI-driven data orchestration and industry-leading on-demand decision engine.

Balance security & convenience

Give customers a ubiquitous, real-time experience at each step of the customer journey to balance security and convenience, using machine learning to dynamically increase or remove friction as risk changes.

Focus on your real customers

Guide customers on a path to passive authentication, only introducing friction when challenge is required. Our solution engages your associates when human experience and intuition is required. More legitimate consumers and transactions will get through faster.

Understand customers’ digital identities

Instantly identify and authenticate the person behind every device. Confidently manage customer identity verification during onboarding and login authentication.

Identify more digital fraud

Bring in third-party data – e.g., biometric, digital ID and behavioral – for transaction enrichment, and implement multiple detection techniques so you can spot more digital fraud across channels, including online banking, mobile, ACH and wire.

why identity & digital fraud analytics?

Convenient identity validation without compromise

Confidently validate digital users’ identities, whether they’re logging into an account or completing an application. Fortify your due diligence with one-stop access to some of the leading data providers and powerful analytics, ensuring fast virtual access for customers.

Easy integration & management of multiple identity management providers

SAS provides a centralized platform that lets you easily integrate and work with the data providers you need, making it easier and less costly to onboard and manage multiple identity providers.

Hybrid analytics delivered as a service for real-time detection of new identity fraud trends

Detect and adapt to new identity fraud trends in real time. A detection strategy powered by SAS can include rules, anomaly detection, machine learning and other statistical approaches. By combining methods, you can identify good customers faster, minimizing identity fraud risk while reducing false positives.

Greater customer confidence, lower costs

Reduce customer friction by enabling faster applications and account login. SAS integrates expanded third-party data with multiple analytic methods, giving you a holistic view of your customer through data enrichment and analytics – keeping customer confidence high and the cost of doing business low.

PUBLIC SECURITY

Spend less time investigating crime and more time preventing it.

Respond faster and more effectively to crime, terrorism and other security threats with a cohesive, analytics-based approach to risk and threat assessment. A single platform gives all agencies a unified view of information across all stages of the intelligence life cycle.

Ensure accurate, reliable intelligence

Our fraud detection software lets you direct, track and audit trustworthy information as it moves through your systems – from planning and collecting to processing, analyzing and disseminating – throughout the intelligence life cycle.

Quickly access security threats and evaluate future risks

Use advanced analytics and data visualization to spot trends and connections that may indicate threats hidden in huge volumes of data. Then send alerts to commanders and officers so they can act quickly.

Stop crime through preventive policing

Conduct more targeted, productive investigations by analyzing and simulating risks to determine which actions are most likely to produce desired outcomes.

Manage borders better

Give agents a big-picture view of all information so they can distinguish between suspicious and legitimate travelers and freight in real time.

Why public security?

Get a single, unified view

Access, integrate, cleanse and standardize security data from virtually any source or format. Automatically link related information across systems to ensure consistency. And interactively exchange reliable information across different platforms and agencies.

Manage with greater speed and efficiency

A single, end-to-end operational solution delivers comprehensive data management, high-performance analytics and data visualization, all tailored to individual agency needs. Fast access to up-to-date information saves valuable research time, which can mean tens of millions of dollars in cost savings.

See all the data, share all the results

Collect, visualize and analyze huge amounts of structured and unstructured data from multiple intelligence sources. Then deepen your knowledge and situational awareness by sharing results in graphical or geospatial formats.

Partner with a trusted provider

With security intelligence solutions from SAS in use at more than 170 public security agencies globally, we have demonstrated expertise in security intelligence, fraud detection and fraud prevention, backed by more than 40 years of experience.